The Lancaster MP has raised concerns about upcoming changes to farm inheritance tax with the Prime Minister.

The UK government is introducing significant changes to the rules from April next year, which will restrict the current 100% tax relief for agricultural property, causing anger among the farming community who argue that the changes could harm many family farms that are asset-rich but cash-poor, potentially forcing the sale of land to pay tax bills.

From April 6, 2026, the full 100% Agricultural Property Relief will be limited to the first £1 million of combined qualifying agricultural and business property. Any value above this £1 million allowance will qualify for only 50% relief.

Tax then due on agricultural property can be paid in up to 10 equal annual instalments, interest-free, to help prevent the forced sale of land to meet the tax bill.

During a committee meeting debating the issue, Cat Smith MP had the opportunity to ask Sir Keir Starmer about the issue, highlighting the distress among local farmers.

Addressing the Prime Minister, Cat Smith said: ‘’I hear from many of the 950 farm holdings in my constituency, that they feel like they were misled around the changes to tax, which are going to pull the rug from underneath farming communities and obliterate the family farm.

‘’For many farmers, we're in a situation now where elderly farmers or farmers with terminal diagnosis are in a position whereby if they die before April, their farm will pass to the next generation with no tax implications, but if they die after there is the potential of their family farm being completely unviable.

‘’Can you see how farmers can feel that this government hasn't necessarily treated them the way that they expect to be treated as working people?

In response, the Prime Minister said: ‘’I do understand the concern, and I met with the president of the NFU (National Farmers Union) just last week, as I've met with him before, to run through the particular concerns they have.

‘’I do think on agricultural property, property relief, there had to be sensible reform. And I think this is sensible reform. There’s a lot of money set aside in the budget. There's a road map that we're agreeing with farmers as to the way forward.

‘’And of course, Minette Batters, the ex president of the NFU has just completed the report for us on profitability and how we drive up profitability year on year, which I think is vitally important, because in a sense, that's the missing factor here, which is the amount of money that farmers can make year on year, and we need to drive that amount up.’’

‘’The vast majority three quarters, I think, of farmers, are not affected at all. And of those that are affected, the rate that's paid is half the rate and that's over a 10 year period.’’

Speaking after the debate, Cat Smith said: ‘’The Prime Minister needs to think again, and reflect on the unintended consequences of inheritance tax changes for farmers. It pains me to hear from farmers willing to expedite their own deaths to secure small family farms that are viable.

‘’The principle of tackling tax avoidance on large country estates I think is correct, but the small family farm risks becoming collateral damage. The well-intentioned updates to the spousal transfer announced at the budget will help some, but not all.

‘’The government will find its £11.8bn in sustainable farming, but will continue to be overshadowed until the forestalling issue is resolved.

‘’Finally, thank you to every farmer in Lancaster and Wyre who has been in touch with me on this issue. Thank you for all the work you do to feed our nation. I will continue to support and listen to you as I always have.’’

In the recent budget, it was announced that any unused portion of the £1 million allowance will be transferable between spouses and civil partners, meaning a surviving spouse or civil partner may be able to benefit from a combined allowance of up to £2 million.

TV star Brian Cox pays a visit to Lancaster’s Police Museum

TV star Brian Cox pays a visit to Lancaster’s Police Museum

Morecambe Football Club confirm details of Fans’ Forum

Morecambe Football Club confirm details of Fans’ Forum

Multiple people treated after carbon monoxide leak at Morecambe address

Multiple people treated after carbon monoxide leak at Morecambe address

Heysham Power Stations alarm tests planned for Christmas Day and New Year's Day

Heysham Power Stations alarm tests planned for Christmas Day and New Year's Day

LISTEN: St John's Hospice in Lancaster set for 40th anniversary year

LISTEN: St John's Hospice in Lancaster set for 40th anniversary year

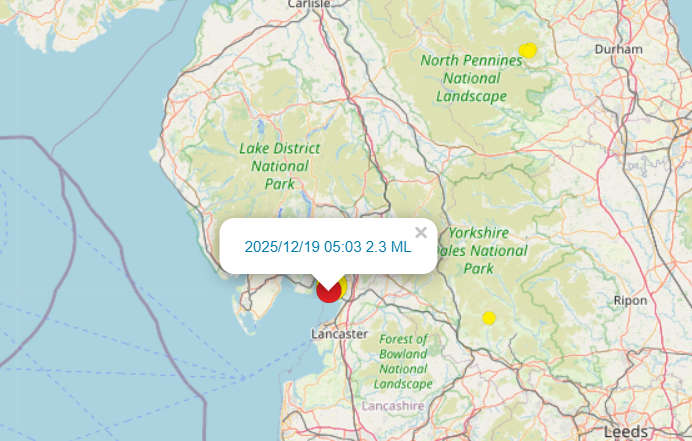

Second earthquake in a month shakes Lancaster and Morecambe Bay

Second earthquake in a month shakes Lancaster and Morecambe Bay

LISTEN: Lancaster Samaritans are there for you at Christmas

LISTEN: Lancaster Samaritans are there for you at Christmas

WATCH and LISTEN: Lancaster band's new music video for song written by Morecambe schoolchildren

WATCH and LISTEN: Lancaster band's new music video for song written by Morecambe schoolchildren

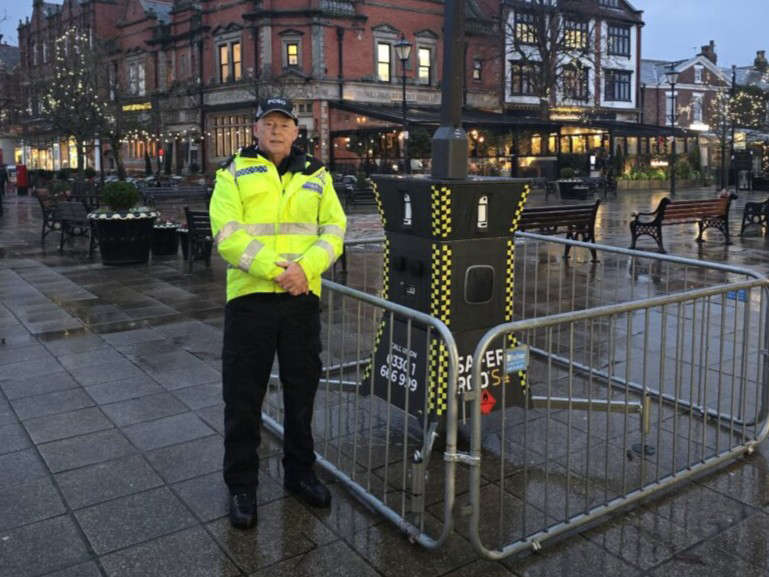

Safer Pod launched to make Lancaster safer during ‘Winter of Action’

Safer Pod launched to make Lancaster safer during ‘Winter of Action’

Police make two arrests after pedestrian critically injured in Morecambe hit and run

Police make two arrests after pedestrian critically injured in Morecambe hit and run

D-Day war hero, 101, to receive Freedom of City of Lancaster

D-Day war hero, 101, to receive Freedom of City of Lancaster

LISTEN: Beyond Radio helps Santa deliver presents from annual Christmas Toy Appeal

LISTEN: Beyond Radio helps Santa deliver presents from annual Christmas Toy Appeal

Modern day mixtape to help fund reopening of Lancaster music facility

Modern day mixtape to help fund reopening of Lancaster music facility

Police investigate Lancaster hate crime graffiti attacks

Police investigate Lancaster hate crime graffiti attacks

Lancaster man jailed again days after being released from prison

Lancaster man jailed again days after being released from prison

Royal Lancaster Infirmary ward reopens to visitors following norovirus outbreak

Royal Lancaster Infirmary ward reopens to visitors following norovirus outbreak

Future of Lancaster day care facility left unclear after council announcement

Future of Lancaster day care facility left unclear after council announcement

Police appeal to help find missing teenager with Lancaster links

Police appeal to help find missing teenager with Lancaster links

Pedestrian critically injured in hit and run in Morecambe

Pedestrian critically injured in hit and run in Morecambe

Have you say on how £20m is to be spent in Morecambe’s West End

Have you say on how £20m is to be spent in Morecambe’s West End